ON Semi Director of Business Development of SensL Division Bahman Hadji publishes a video "Which Wavelength Will Prevail for Automotive LiDAR – The Great Debate."

Lists

Thursday, December 31, 2020

Wednesday, December 30, 2020

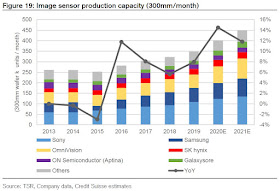

Samsung Plans to Leapfrog Sony with New 20nm Process

JoongAng Ibo: Samsung VP Yong-in Park has been recently promoted from HR to the System LSI Division Strategic Marketing Manager. One of his first decisions was to convert the remaining DRAM capacity on Line 11 to image sensor manufacturing.

The reason Samsung Electronics is converting its DRAM line to image sensor is that it is building a large-scale new DRAM production facility at the Pyeongtaek plant. The Pyeongtaek plant will mass-produce the 4th generation 10-nano class (1a) DRAM using the EUV process from next year. Due to the massive increase in DRAM production capacity, Hwaseong Line 11, which made 20-nano or higher-class DRAM, will be converted into an image sensor for line efficiency.

The newspaper says that (in Microsoft translation) "Sony is still more of ahead in its optical ability to convert light into images. Apple and Huawei have been using Sony products instead of using Samsung image sensors."

Tuesday, December 29, 2020

2020 Acquisitions & IPOs

As 2020 nears its end, there was a number of image sensor companies acquisitions:

- Smartsens acquired Allchip (automotive image sensors)

- Nordson acquired vivaMOS (X-Ray sensors)

- GE Health acquired Prismatic Sensors (X-Ray sensors)

- Goodix acquired Dreamchip (digital design services team)

- TE Connectivity acquired First Sensor (SPADs, APDs, InGaAs, and p-i-n photodiodes)

- LeddarTech acquired VayaVision (sensor fusion and perception software for LiDARs)

- Allegro acquired Voxtel (LiDARs)

- Seegrid acquired Box Robotics (LiDARs)

- ams acquires Osram (adds laser and LED products to complete 3D sensing portfolio)

- Nuvoton acquired Panasonic semiconductor business (including image sensor and stake in TPSCo fab)

- Jenoptik acquired Trioptics (camera module test and measurement equipment)

- Sony acquired Insightness (event-driven sensors)

- Celepixel was acquired by Will Semiconductor (event-driven sensors)

- Galaxycore (mobile sensors)

- Velodyne (LiDAR, merger with SPAC)

- Luminar (LiDAR, merger with SPAC)

- Aeva (LiDAR, merger with SPAC)

- Innoviz (LiDAR, merger with SPAC)

- Ouster (LiDAR, merger with SPAC)

Monday, December 28, 2020

The Richest Man in China's Semiconductor Industry is "Image Sensor Man"

Halo Finance, DayDayNews: Will Semiconductor chairman and Omnivision CEO Renrong Yu is the richest man in China semiconductor industry. Will Semi is a mother company of Omnivision, Superpix, and Celepixel.

This year, Renrong Yu is ranked 65th on the Forbes China Rich List with a wealth of 51.38 billion yuan ($7.86 billion), an increase of 21.12 billion yuan over the last year. Compared with 2017, the value has increased by nearly 15 times.

On May 4, 2017, at IPO time, the stock price of Will Semi shares was 7 yuan. On December 25 this year, the stock price of Weir shares was 220 yuan, with a total market value of 190.872 billion. The stock price has increased by more than 30 times in 3.5 years.

Will Semi shares have become a "dark horse" with a market value of 100 billion, thanks to the "snake swallowing elephant" acquisition of Beijing Omnivision. It is worth mentioning that in 2018, when Will Semi decided to acquire Omnivision at a price of 13 billion yuan, Omnivision's total assets were almost 5 times that of Will's and its net assets were nearly 8 times.

Renrong Yu has graduated from Radio Department of Tsinghua University in 1990. He belongs to the group of alumni of this University that many Chinese semiconductor executives originating from. The incomplete list includes Zhao Lixin, founder of Galaxycore Microelectronics, Zhao Weiguo, founder of Tsinghua Unigroup, Shu Qingming, one of the founders of GigaDevice, Feng Chenhui, co-founder of Maxscend Microelectronics, and Zhao Lidong, founder of Enflame Technology, all studied at Tsinghua University Radio Department in 1985-1990.

Sunday, December 27, 2020

Silicon Integrated Raises $25M in Round B

- HVGA (480 x 360) resolution for SIF2310 and VGA (640 x 480) resolution for SIF2610

- Back-side illumination

- Ambient light immunity

- Compatible with 850nm/940nm LED/VCSEL light source

- QE>30% at 940nm

- Up to 100MHz modulation frequency

- 240fps raw data frame rate

- Region of interest (ROI) function

- Absolute accuracy < 1% up to 5m

- Global shutter

- Opto-package

Saturday, December 26, 2020

Global TCAD Solutions for CIS

Friday, December 25, 2020

2-stage LOFIC Sensor with 120dB DR

Sony Article about Awards for Stacked Sensors

Thursday, December 24, 2020

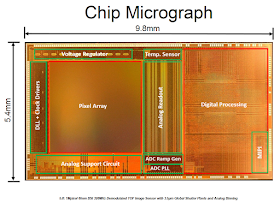

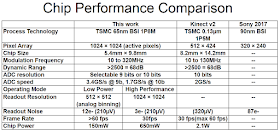

ADI Unveils 1MP 3.5um Pixel BSI ToF Sensor

Analog Devices unveils what appears to be the first fruit of cooperation with Microsoft ToF group (former Canesta). The ADSD3100 sensor targets smartphones, AR/VR systems, and machine vision applications in logistics, inventory, industrial, and consumer fields.

The new sensor features:

- 1024 (horizonal) × 1024 (vertical) pixel array

- 3.5 μm × 3.5 μm square pixels

- 1/3.6 inch optical format

- BSI

- Depth and intensity imaging

- 4-wire SPI or 2-wire I2C serial interface

- Die size: 5.364 mm × 9.799 mm

- MIPI CSI-2 Tx interface with support for 1, 2, or 4 data lanes, programmable up to 1.5 Gbps per lane

- Dual, 3.3 V and 1.27 V external supplies, 1.8 V I/O section

Wednesday, December 23, 2020

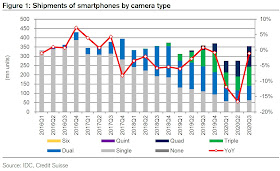

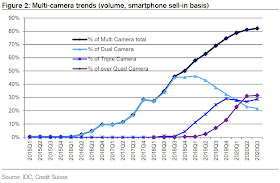

Credit Suisse on Smartphone Camera Market

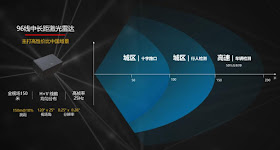

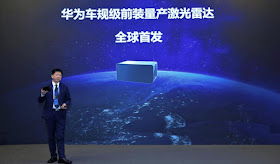

Huawei Unveils its First Automotive LiDAR and Begins Pilot Production

CnTechPost, GizChina, InfNews, Huawei: Huawei announces its first automotive LiDAR product. Few key points from the announcement:

- 120 x 25 deg FOV

- 0.25 x 0.26 deg resolution

- 96 lines

- 150m range at 10% target reflectivity

- 200m range at 50% target reflectivity

- BAIC (Beijing Automotive) is the first customer

- Huawei has built a pilot production line with capacity of 100K units per year

- The development has started in 2016 and took 4 years

Tuesday, December 22, 2020

Hot, Cold, Warm, and Cool Pixels in Event-Driven Cameras

Australian National University paper "Event Camera Calibration of Per-pixel Biased Contrast Threshold" by Ziwei Wang, Yonhon Ng, Pieter van Goor, and Robert Mahony discusses pixel mismatch issues in event-driven cameras:

- Hot Pixels are pixels that have lower threshold values than the assumed value. This means that both positive and negative events are generated more often than expected.

- Cold Pixels are pixels that have higher threshold values than the assumed value. This means that both positive and negative events are generated less often than expected.

- Warm Pixels are pixels that have negative bias values. This means positive events are triggered more often, and negative events are triggered less often than expected.

- Cool Pixels are pixels that have positive bias values. This means negative events are triggered more often, and positive events are triggered less often than expected.

BMW In-cabin Monitoring with Melexis ToF Camera

Ouster Goes Public via Merger with SPAC

BusinessWire: San Francisco-based LiDAR startup Ouster is said to close a deal to go public at a about $1.9B valuation through a merger with SPAC Colonnade Acquisition Corp. Up to now, Ouster has raised $142M in the previous investment rounds.

The new transaction is expected to provide up to $300M in gross proceeds, comprised of Colonnade Acquisition Corp.’s $200M of cash held in trust and a $100M fully committed common stock PIPE.

The company's Investor Presentation talks about its LiDAR sales and forecasts:

Monday, December 21, 2020

2021 International Image Sensor Workshop Call for Papers

The next International Image Sensor Workshop (IISW) is going to be an on-line event on Sept. 20-24, 2021. The First Call for Papers has been published on International Image Sensor Society web site:

"The 2021 International Image Sensor Workshop (IISW) provides a biennial opportunity to present innovative work in the area of solid-state image sensors and share new results with the image sensor community. Now in its 35th year, the workshop is intended for image sensor technologists; in order to encourage attendee interaction and a shared experience, attendance is limited, with strong acceptance preference given to workshop presenters. As is its tradition, the 2021 workshop will emphasize an open exchange of information among participants.

Submission of abstracts:

An abstract should consist of a single page of maximum 500-words text with up to two pages of illustrations, and include authors’ name(s) and affiliation, mailing address, telephone and e-mail address. The deadline for abstract submission is April 17th, 2021 (CST).

Please visit http://imagesensors.org/CFP2021 for the abstract and paper submission procedures.

Abstracts will be considered on the basis of originality and quality. High quality papers on work in progress are also welcome. Abstracts will be reviewed confidentially by the Technical Program Committee and the IISS Board.

Authors will be notified of the acceptance of their abstract by June 3th, 2021.

Final-form 4-page paper submission date is August 6th, 2021.

Presentation material submission date is September 13th, 2021.

Location and format:

The IISW 2021 is planned to be held Sept 20-24th. Given the outlook of the pandemic situation and related travel restrictions, the workshop is expected to be an online event, which will be supported by several initiatives to preserve its interactive and open atmosphere. The workshop will not be delayed: in any case the selected papers will be presented in September 2021. More details on the format will be provided in February 2021 with the final call for papers."