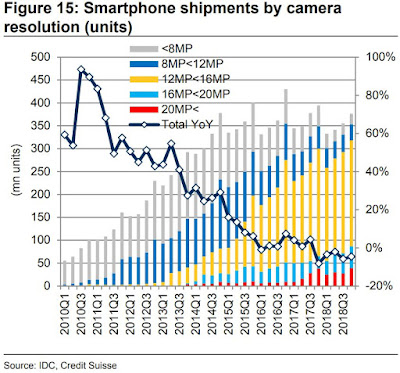

"We note a sustained shift toward higher image resolution and multi-camera imaging systems in CIS. In Oct–Dec 2018, the multi-camera adoption rate fell briefly to 43% due to a slump in Apple’s dual-camera-equipped OLED models (vs. 65% in Jul–Sep and 58% in Oct–Dec 2017). However, we note the trend accelerating in non-Apple Android devices with 52% (43%, 21%). The multi-camera system adoption rate across smartphones finished at 40% in 2018 (vs. our initial outlook for 40%). We raise our estimate for the multi-camera system adoption rate to 60% in 2019 (prev. 50%). Within multi-camera systems, we raise our estimate for triple-camera systems to 15% in 2019 (10%) and forecast 70% and 22%, respectively in 2020. Sony’s image sensors registered a sales decline in Oct–Dec 2018 due to production adjustments in iPhones and Chinese smartphones, but we forecast an upturn in YoY momentum from Jan–Mar. Our outlook for profit growth at the business in FY3/20 and FY3/21 remains intact due to product mix improvement driven by faster uptake for multi-camera systems and the shift to larger/higher-resolution images.

- Cameras: OLED models for 2019 will likely feature a triple-lens rear camera (12mp) and we expect liquid crystal models to be upgraded to a dual-camera configuration. As in our previous survey, we think OLED models will very likely use Dual OIS and fixedfocus actuators and LCD models will use Dual OIS. Apple is apparently considering larger lenses for 2020 models and SMA (Shape Memory Alloy) for OIS. We also expect 2020 models to feature Dual OIS and actuators for front-facing cameras.

- ToF: We expect ToF for rear-facing cameras to be adopted after 2020 rather than in 2019, and think Apple will very likely use UWB (ultra-wide band) microwave for distance measuring sensors. We expect indirect ToF to feature after 2020."

"New features and technologies in Chinese smartphones

We had forecast in the previous survey that adoption of triple-camera systems and 48MP sensors would accelerate in CY19, and our latest survey confirms this. ...Sony will likely be the sole supplier of these for spring models. Samsung’s LSI 12MP/48MP re-mosaic technology is lagging and had been slated for launch in 2H CY19, but we think Samsung will skip real 48MP and concentrate instead on developing 64MP sensors for a 2H release. We also see an increasing possibility of 108MP sensors launching in 2020.

We estimate that Chinese demand for 24MP CIS, mainly for phones with two front-side cameras, reached around 100mn units in CY18 and look for 150mn units of rear-side 48MP demand in CY19.

Companies like Huawei, Oppo, and Xiaomi are considering adopting 5x-zoom folded optics systems. The issue with folded optics is low production yields on actuator module assembly. Sensor size is meanwhile limited by considerations of phone thickness, making higher resolutions difficult as well.

We sense that demand is increasing for shape memory alloy (SMA) OIS over VCM-type actuators/OIS in response to the increasing size and number of lenses. Phone makers are also considering using a glass lens in the lens unit for f/1.4 and smaller and 108MP sensors, with the resulting increase in weight another factor likely to drive demand for SMA and ball-guide OIS.

Pop-up selfie cameras have also begun appearing on at least one model from each manufacturer, but not so far on their mass-produced flagships."

Another Credit Suisse report talks about multi-camera adoption and sensor resolution trends:

- Demand from Huawei (32MP CIS mass production) and Xiaomi (long-term contract) has helped Samsung to gain market share in CIS.

- Multi-camera smartphones are expected to comprise 65–70% of all models in 2019, up from 40% in 2018. Triple-camera models are expected to account for as much as 20% of all smartphone handsets (up from 1.5% in 2018).

- The multi-camera percentage for Samsung Mobile is expected to reach 70% in 2019 (up from 21% in 2018).

- Demand for 5MP CIS is booming due to the trend toward multi-camera smartphones (the 5MP CIS is an essential component of triple-camera handsets).

- The CIS technology roadmap calls for further evolution towards higher megapixels, with development expected to bring 64MP in 2H 2019 and 100MP in 2020. The trend will increase the number of lenses required (though weight is an issue), demanding higher levels of cooperation between lens, module and AP manufacturers to achieve incremental improvements in image resolution.

- With Line 11 undergoing conversion, Samsung is planning to boost the total monthly capacity of its CIS 300mm production lines to 75,000 units by end-2019 and 85,000 units by end-2020. No decision has been taken yet on whether to convert Line 13 to CIS production, but the general plan is to continue expanding capacity steadily.

- CIS 300mm line development is underway at SK Hynix.

The smartphone market size in terms of units has started to shrink from the end of 2017, according to Credit Suisse:

No comments:

Post a Comment

All comments are moderated to avoid spam and personal attacks.