In the first quarter of 2022, the global mobile phone image sensor shipments will be approximately 1.13 billion units, a year-on-year decrease of approximately 27.0%.

Market demand in Europe and mainland China has suffered multiple blows, and the Latin America market may be able to stand out

The upgrade of pixel specifications shows polarization, "main camera up, sub camera down"

Leading manufacturers will use production capacity advantages to control supply or change the adversity, and local manufacturers will seek opportunities through differentiation

Suggestion: Improve product functional value, upgrade product structure, and be cautious in large-scale expansion

Suggestion: Improve product functional value, upgrade product structure, and be cautious in large-scale expansion

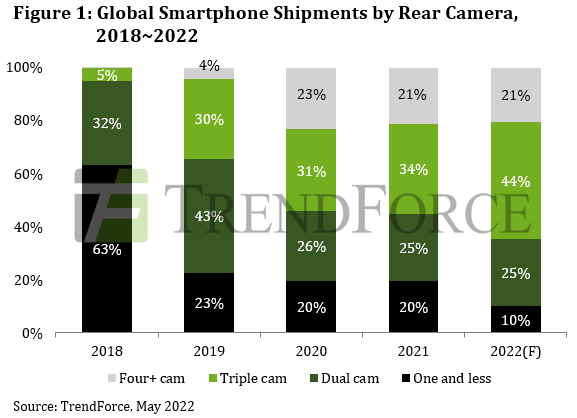

A recent report by TrendForce forecasts that the relative share of quad-camera module market will not grow much between 2021 and 2022. One explanation might be that there is diminishing returns beyond a certain number of cameras and smartphone companies are focusing on algorithmic enhancements to image/video quality which may give similar results.

TrendForce indicates that mobile phone brands are currently curtailing competition in the hardware specifications of mobile phone camera modules but remain focused on photographic and video performance as promotional features of their mobile phones and will emphasize dynamic photography, night photography and other scenarios to highlight product advantages. This can be achieved not only by strengthening the optical performance of the camera module itself but also through algorithms and software, thereby increasing the enthusiasm of mobile phone brands to invest in self-developed chips.

another recent article about image sensor market share situation/recent changes: https://asiatimes.com/2022/07/sony-samsung-duel-for-image-sensor-lead/

ReplyDelete