From Businesswire: https://www.businesswire.com/news/home/20230725606397/en/Ubicept-Raises-8M-to-Unlock-Computer-Vision-in-All-Lighting-Conditions-by-Counting-Individual-Photons

Ubicept Raises $8M to Unlock Computer Vision in All Lighting Conditions by Counting Individual Photons

Company plans to use capital to attract new talent and expand into several new industries including 3D scanning and industrial automation

BOSTON--(BUSINESS WIRE)--Ubicept, the revolutionary computer vision technology company, today announced it has secured $8M in funding. The oversubscribed seed investment round was led by Ubiquity Ventures and E14 Fund, with participation from Wisconsin Alumni Research Foundation, Phoenix Venture Partners (PVP), and several other investors and angel contributors.

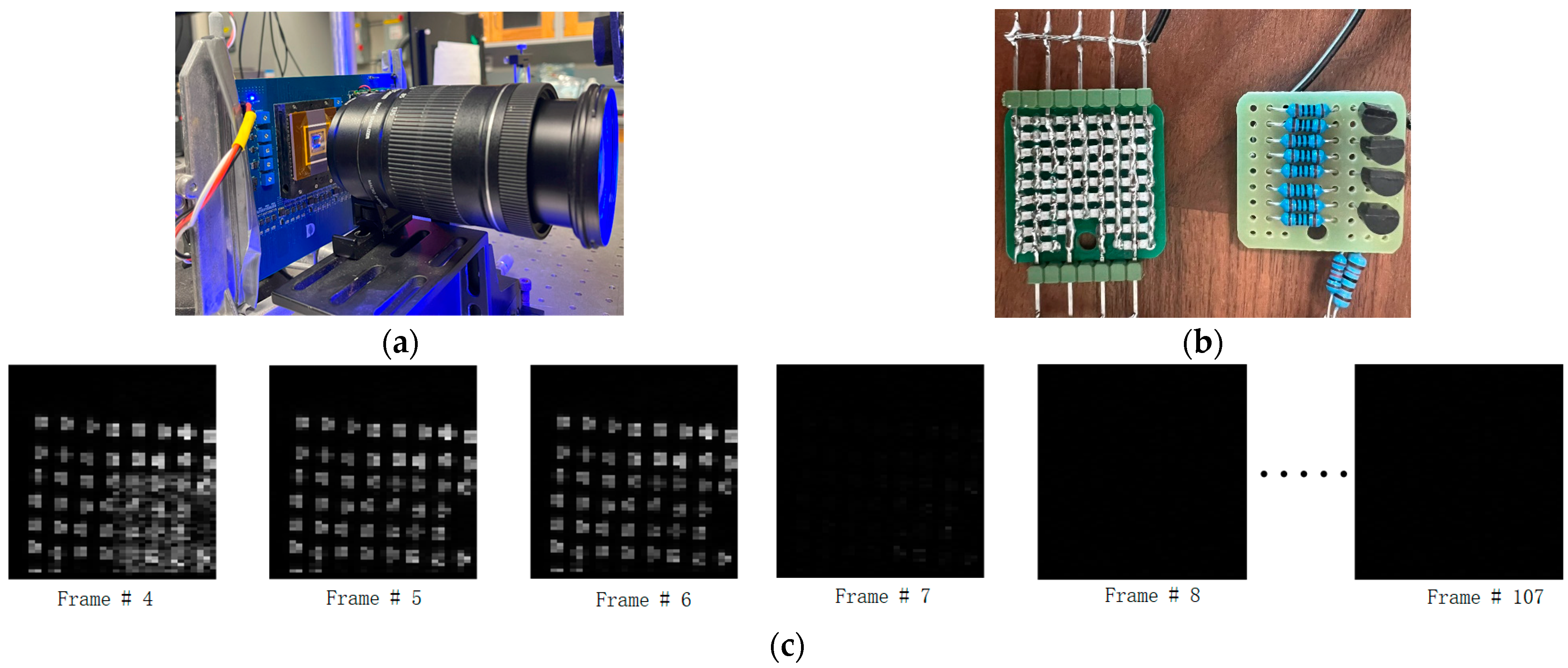

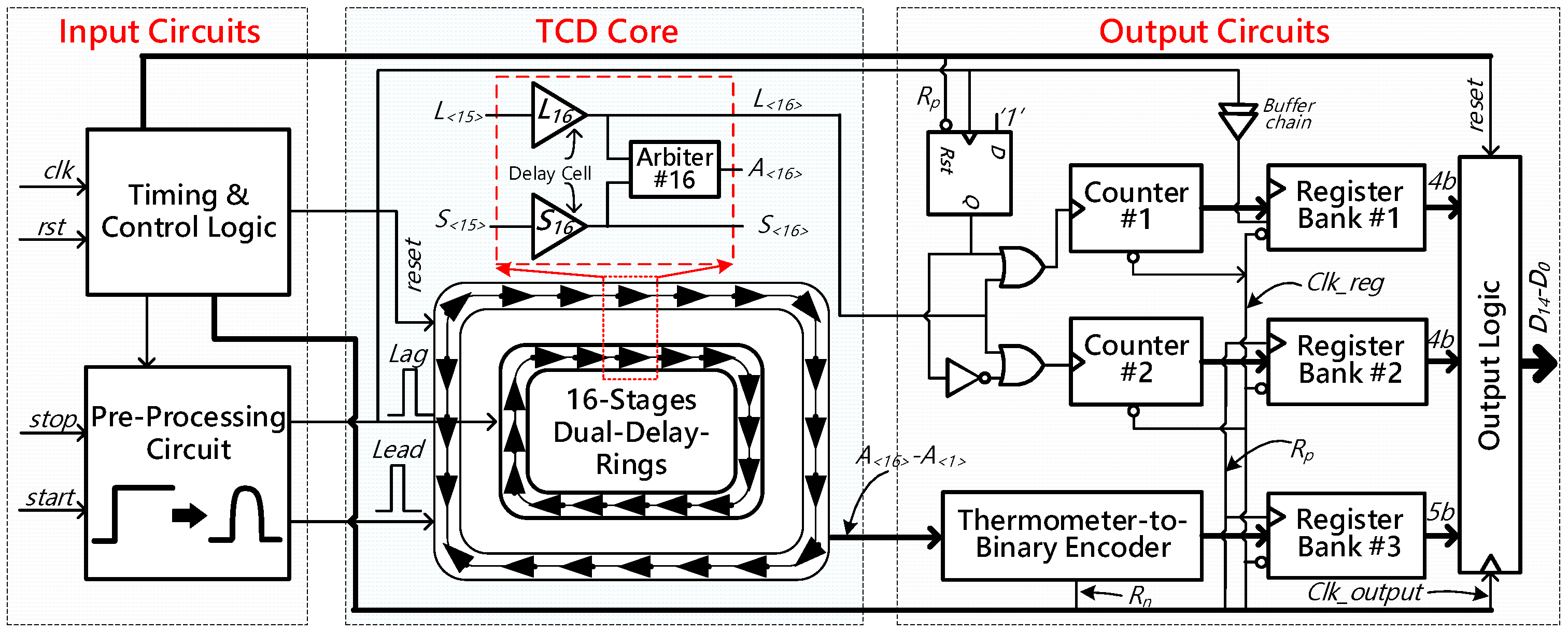

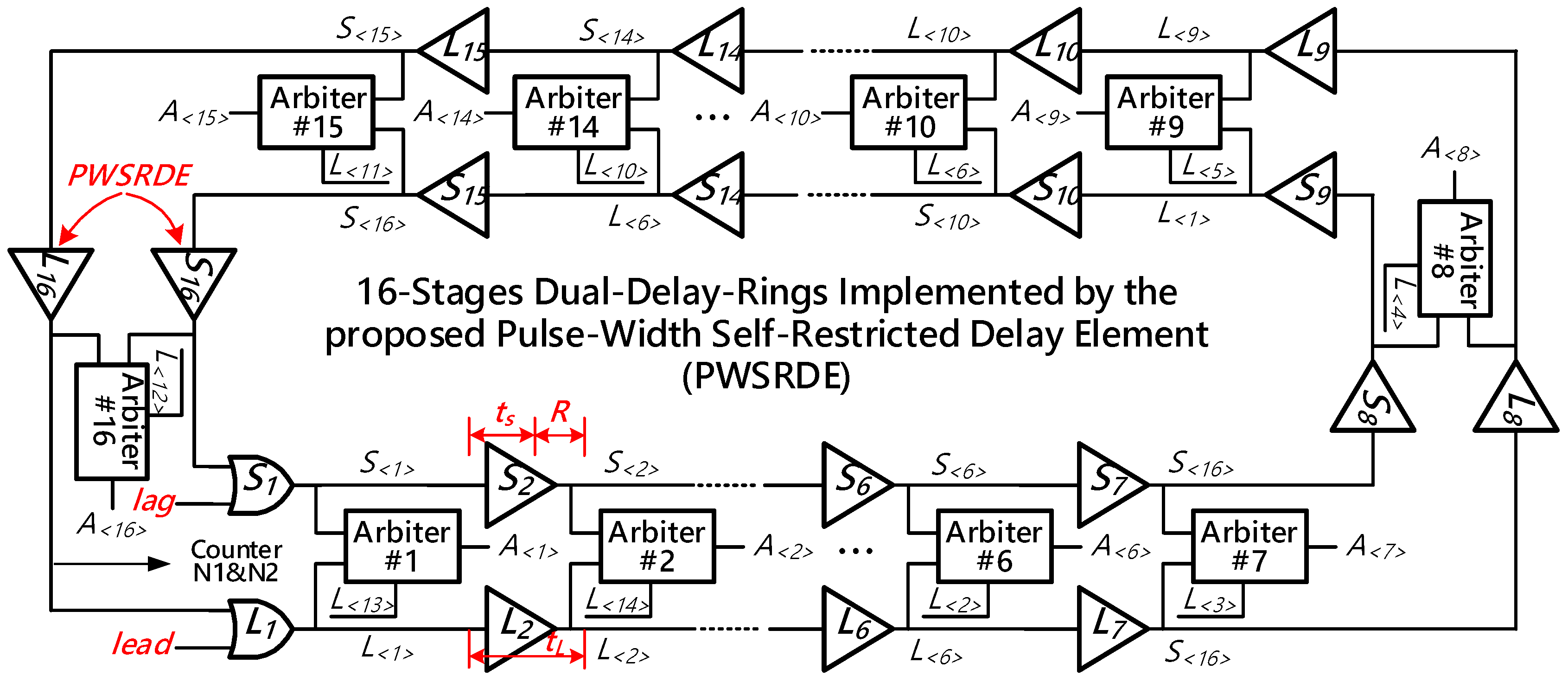

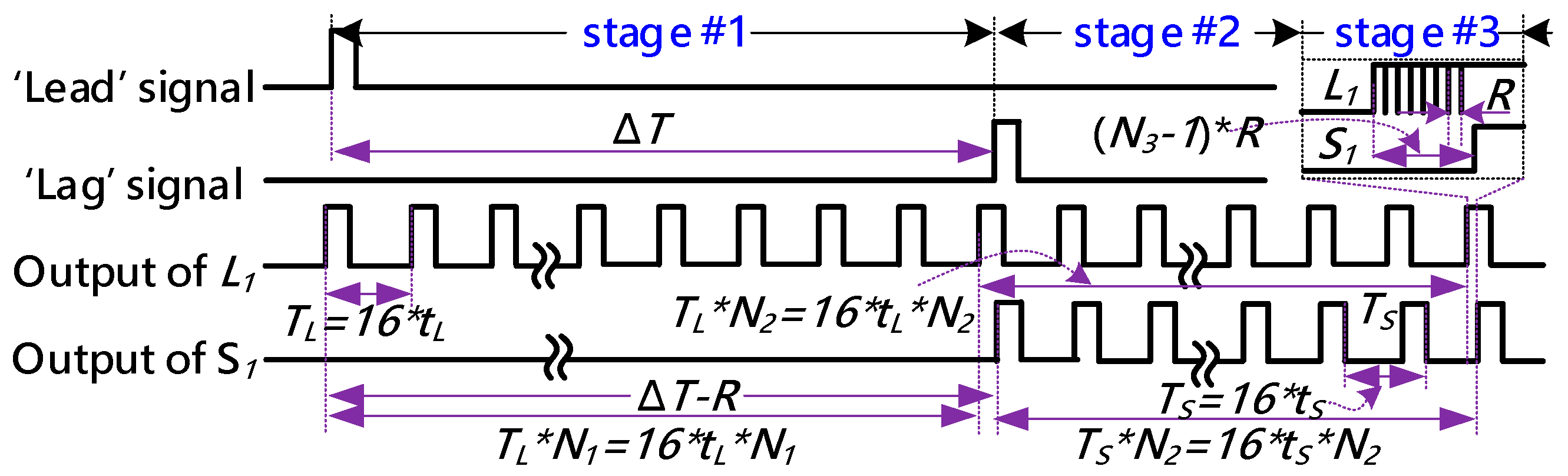

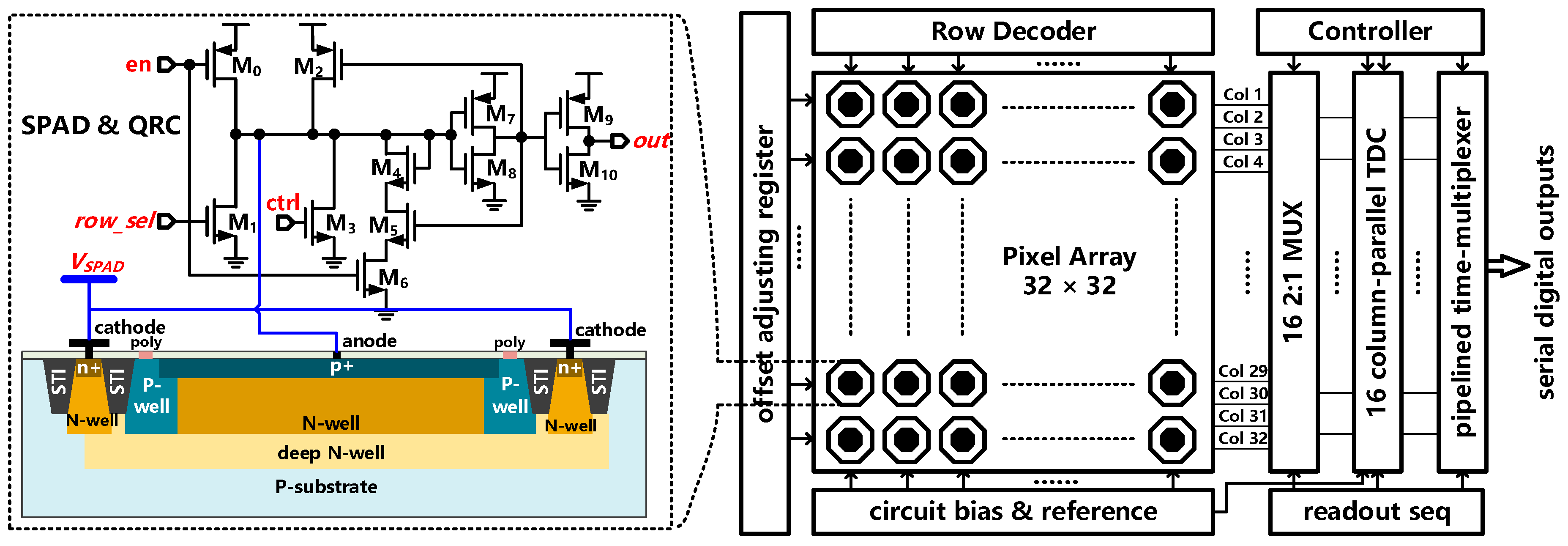

Born out of the world-class labs of MIT and University of Wisconsin-Madison, Ubicept is redefining boundaries in the field of computer vision. Traditional computer vision relies on a dated "still frame" approach, whereas Ubicept bypasses this old logic and directly leverages single-photon sensors to turn the individual photons that hit an imaging sensor into a reliable computer vision output. The resulting perception system can operate in extreme lighting conditions, capture sharp images of high-speed motion, and even "see" around corners. Ubicept targets a price point similar to conventional camera systems.

“We are excited about this major milestone. This funding will allow us to accelerate our efforts to transform the way computers 'see' and understand the world, especially in challenging environments," said Sebastian Bauer, co-founder and CEO.

"Ubicept is the first company in the world with this "count individual photons" approach to computer vision. I see tremendous demand right now for this next generation of perception and the use cases it unlocks," said Sunil Nagaraj of Ubiquity Venture. Mr. Nagaraj has also joined the Ubicept Board of Directors.

Habib Haddad, Managing Partner of E14 Fund, adds: “The development in the market for single-photon sensors has picked up dramatically in the last few years, with smartphone manufacturers adding them to their devices for depth sensing. The processing Ubicept adds to such sensor type will enable their widespread use for general-purpose imaging and a wide array of computer vision applications. The output quality is so much better than what conventional sensors provide.” The new capital will be used to expand the Ubicept team, secure further intellectual property rights, and bring their product to more customers across several industries. This investment will strengthen Ubicept's position as the leader in single-photon computer vision. https://www.ubicept.com/

About Ubicept

Ubicept is a computer vision startup spun out of the labs of MIT and UW-Madison. The company is developing advanced computer vision and image processing algorithms using single-photon sensitive image sensors that can function in extreme lighting conditions, swiftly capture motion, and even see around corners.

About Ubiquity Ventures

Ubiquity Ventures is a seed-stage institutional venture capital firm that invests in "software beyond the screen" startups and has over $150 million under management. Ubiquity's portfolio includes B2B technology companies that utilize smart hardware or machine learning to solve business problems outside the reach of computers and smartphones. By transforming real-world physical problems into the domain of software, Ubiquity startups tap into large greenfield markets and offer more effective solutions. See more details on the Ubiquity Ventures website at http://www.ubiquity.vc.

About E14 Fund

E14 Fund is the MIT-affiliated, early stage venture capital firm. E14 Fund invests in MIT deep tech startups that are transforming traditional industries across a broad array of market-ready, scalable innovations in AI/ML, robotics, climate, biomanufacturing, life sciences, material science, sensing and more, supporting its portfolio and community with resources from across the MIT ecosystem. For more information, visit www.e14fund.com.