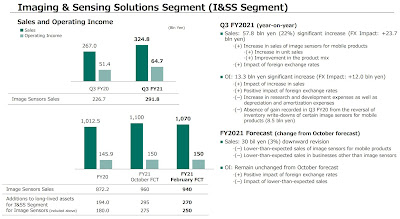

Sony reports its quarterly results for the quarter ended on January 31, 2021:

- Despite severe conditions in the smartphone market, such as weakness in the Chinese market and shortages of components, especially semiconductors, the efforts we have made heretofore to expand and diversify our mobile sensor customer base, as well as to recover our market share on a volume basis, are having some success.

- However, it is taking longer than expected to introduce the high-performance, high resolution custom sensors that we have been working on with Chinese smartphone makers, so the speed of profitability improvement resulting from an increase in addedvalue products going into next fiscal year will be slightly lower than originally planned.

- Recently, the trend toward Chinese smartphone makers purchasing larger-sized sensors for their high-end products is improving after having stagnated due to the contraction of our business with a certain Chinese customer. We expect the Chinese smartphone market to normalize in the second half of next fiscal year.

- Since we feel better about the possibility of sales growth and further market share expansion next fiscal year, we will focus even more on increasing the added-value of our products and strive to improve profitability.

- On January 25, 2022, Sony Semiconductor Solutions Corporation completed its initial investment in Japan Advanced Semiconductor Manufacturing Co., Ltd. (“JASM”), as a minority shareholder.

- Sony will support JASM by assisting with the start-up of this new logic wafer factory which aims to begin mass production during calendar year 2024.

The percentage of "non-mobile" sensors in this results would be interesting to know. Sony puts a lot of effort into higher end niches, like the industrial global shutter sensors, and i guess they are quite successful there. Of course they have less sensors there but per sensor the price is maybe x100 vs. a mobile sensor. Do they indicate this somewhere?

ReplyDeleteas addition to the previous comment, I try to do a "gut feeling" guess for a magnitude... In reports like http://image-sensors-world.blogspot.com/2021/01/yole-on-machine-vision-market.html, the total market volume for image sensors in the "machine vision", robotic, automation etc. segment seems to be in the 500M$ ballpark in 2021. When Sony has about 40-50% market share in this segents, its about a 200M$ magnitude. They predict here about 900BYen for FY21, which is about 7B$ - so we end up in the 10% magnitude that industrial/automation etc. sensors contribute to sony business, right?

ReplyDeleteSony has significant market share in Photography, Security, and yes industrial segment (but below 50%, Onsemi, Teledyne, ams and now GPixel combined are above 50%)so even though the reasoning is not totally right, I agree with the end result and would reformulate :only 10% of Sony's Image Sensor business is beyond Mobile (including tablets) - Pierre Cambou Yole Développement

ReplyDeletei was a bit off, right? 200m is 3% of 7b, not 10 ;-)

Delete