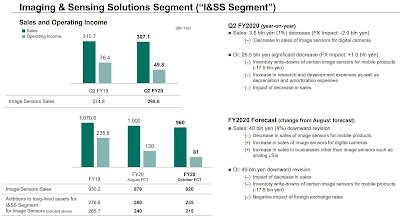

- FY20 Q2 sales decreased slightly year-on-year to 307.1 billion yen and operating income significantly decreased 26.5 billion yen to 49.8 billion yen.

- FY20 sales are expected to decrease 40 billion yen to 960 billion yen and operating income is expected to significantly decrease 49 billion yen to 81 billion yen.

- Even accounting for the decrease in operating income in FY20, we expect the difference between the total of operating cash flow and investing cash flow for the segment over the three fiscal years begun April 1, 2018 to be positive.

- Pursuant to export restrictions announced by the U.S. government on August 17, 2020 we terminated product shipments to a certain major Chinese customer [Huawei - ISW] as of September 15, 2020.

- The forecast disclosed today for the second half of this fiscal year does not include any shipments to that customer.

- In addition, the operating income for the quarter includes an approximately 17.5 billion yen write-down of finished goods and work-in-progress inventory for that customer recorded at the end of September.

- Based on this situation, we are further revising the business strategy, as I explained at the previous earnings announcement, from the perspective of capital expenditures, research and development and customer base.

- We are further postponing the timing of capital expenditures, with cumulative capital expenditures for the three fiscal years begun April 1, 2018 expected to be reduced 40 billion yen from the approximately 650 billion yen I explained last time.

- We do not think it is prudent to prematurely reduce research and development spending because we want to meet the needs of a wide range of smartphone customers, as well as maintain and increase our future technological competitive advantage.

- We have had some success expanding and diversifying our customer base for FY21. The financial impact on our business in FY20 is limited, but we think it is possible to recapture, in FY21, a large portion of the market share, on a unit basis, we lost this fiscal year.

- However, we expect that it will take a long time for other customers to follow the trend to higher-functionality and larger die-sized smartphone cameras that the Chinese customer [Huawei - ISW] was leading. Thus, we expect the substantial recovery of profitability driven by these high value-added products to take place in the fiscal year ending March 31, 2023 (“FY22”).

- By recapturing market share in FY21 through an increase in sales of commodity sensors, and by recouping our business profitability in FY22 through more high valueadded products, we aim to return the mobile image sensor business to growth.

- In addition, there is no change to our mid-to long-term strategy of growing our business through expansion of applications that use edge AI and 3D sensing capabilities, as well as through starting up automotive sensors in earnest.

Wednesday, October 28, 2020

Sony Reports 1% Decrease in Image Sensor Sales, Reduces Forecast

Sony reports its quarterly results and updates on its image sensor business:

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

All comments are moderated to avoid spam and personal attacks.